Welcome to Investment Fund

Conducting real investment research, equity analysis, and advanced valuation methods to create tailored recommendations to help meet portfolio objectives.

Sector Coverage

-

Technology, Media, Telecommunications

The technology, media, and telecom (TMT) sector is an industry grouping that includes companies focused on new technologies. Companies in this industry focus on hardware, software, media, and telecom.

-

Healthcare

The healthcare sector consists of businesses that provide medical services, manufacture medical equipment or drugs, provide medical insurance, or otherwise facilitate the provision of healthcare to patients.

-

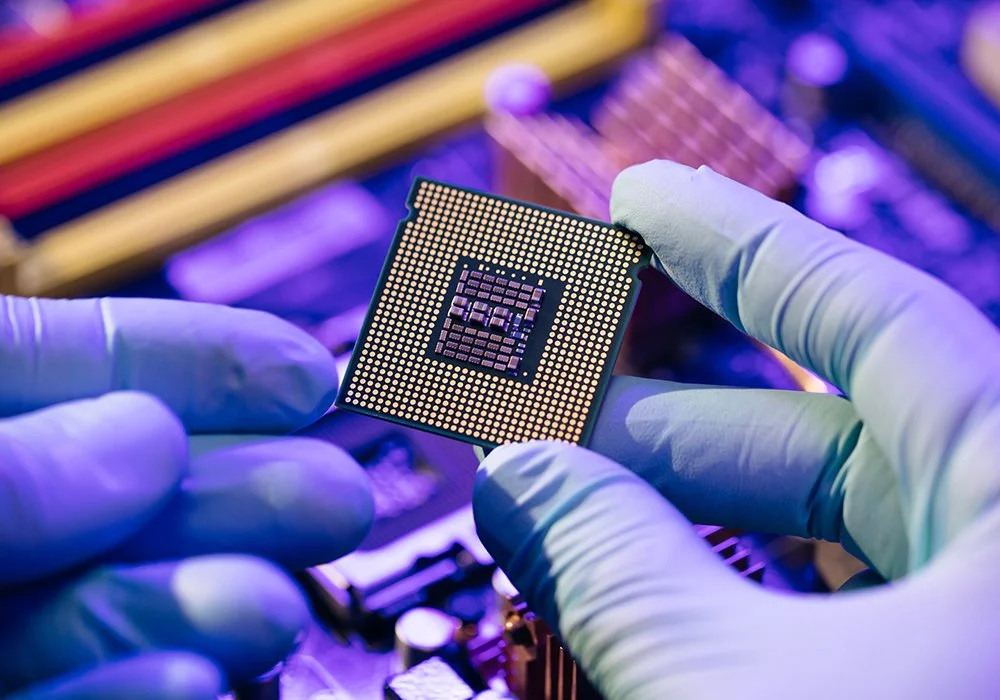

Software & Semiconductors

The software and semiconductor sector focuses on companies that create the components found in thousands of products such as computers, smartphones, appliances, gaming hardware, and medical equipment.

-

Consumer & Retail

Consumer & Retail focuses on equity research on companies in the food and drink, consumer goods, luxury and retail sectors. Consumer goods are segmented into consumer staples (or consumer non-cyclical) and consumer discretionary (consumer cyclical).

What Do Investment Fund Members Gain?

Financial Modeling

Fund members develop deep financial modeling skills from their consistent construction of complex financial models to evaluate potential investments and forecast performance. Analysts develop their ability to build intricate financial projections and analyze investment opportunities.

Analytical Thinking Skills

Members get the opportunity to hone in analytical thinking skills, regularly dissect financial data, assess market trends, and analyze investment opportunities. Through this hands-on experience, our Fund members learn to apply analytical thinking systematically, equipping them with valuable decision-making abilities in the world of finance.

Accounting Skills

Fund members develop strong accounting skills from their consistent exposure to financial reports and assessing the financial health of a company. This hands-on experience enables participants to gain practical expertise in accounting principles, a valuable asset for financial analysis and decision-making.

Writing Skills

Through Fund, members develop strong writing skills, including consistent practice in articulating comprehensive investment reports, research findings, and persuasive proposals. As Fund members refine their writing abilities, they gain the proficiency to communicate complex financial ideas clearly and convincingly.

Microsoft Excel and Powerpoint

Fund members develop proficiency in Microsoft PowerPoint and Excel, frequently utilize these tools to create comprehensive investment presentations and perform data analysis. Through active involvement in crafting financial models and pitch decks, members enhance their Microsoft Office skills.

Public Speaking

Throughout the semester, Fund members practice the skill of public speaking within through the frequent practice in articulating complex financial concepts and investment strategies to other members. We present analyses and recommendations, and through this practice, cultivate confidence and the ability to convey financial insights effectively.

Testimonials from the Fund Community

Investment Fund Leadership

Interested in exploring Investment Fund further?

All new TAMID recruits go through a semester of education where they are exposed to the fundamentals of business, networking, finance, and consulting. This provides a low-risk environment for TAMID members to learn while exploring the different TAMID track offerings.